I started my blog talking about missed opportunities from not hearing great pieces of advice, well it's only fitting my second entry is about the great tips i did consider.

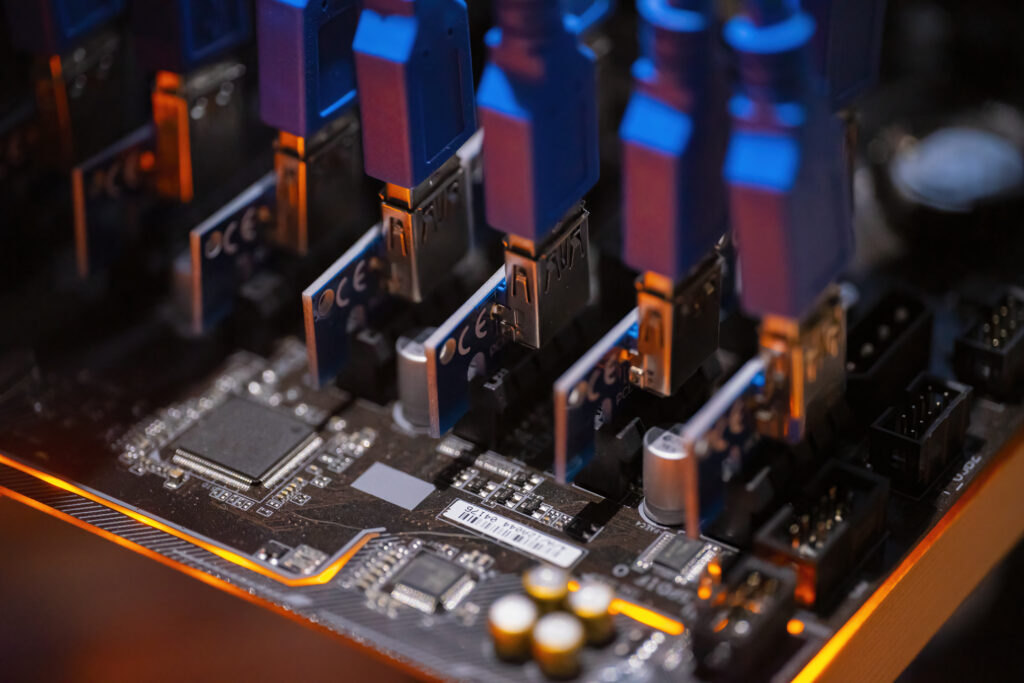

Briefly after I got into mining through the Son Of Tech How to mine Ethereum in 2021 video, I was introduced to one of the mining OG’s: BitsBeTrippin. His channel is one of the best educational resources I’ve found not just for GPU mining but for crypto in general. He offers a lot of useful information about how blockchain and networks work and in one of his videos he talked about the importance of saving a few GPUs of one’s farm to do speculative mining.

Spec mining or speculative mining means you mine not the most profitable coin(which tends to be the most obvious thing to do) but a coin with low difficulty you believe it can have great price action in the future. So I decided to dust off an old GTX 970 and start mining a coin called Zel I found digging through a bunch of Reddit threads, the coin was renamed in march 2021 to Flux, a project most of Web3 adepts must know by now. At that time, price of Flux was around 20 cents and I was mining 7 Flux a day on a card that was launched in 2014.

During the weekends I would also swap my 10 series cards (2x1060, 1x1080 and 1x1070) from Ethermine to Fluxpools to scoop more $Flux and that would yield me around 40 Flux a day. This would turn out to be one of my biggest wins in the 2021 Bull market, as the price of $Flux had a huge spike to above 3 USD. Which means I had been mining over 120 USD a day with a bunch of old cards and that’s not even counting Parallel assets I would later receive.

I know #GPU mining seems dead lately due to current market conditions and the fact that Ethereum hashrate migration basically saturated all other PoW projects, but if you can afford to cover electic out of pocket, try spec mining on a few cards, don’t swap daily for the “most profitable” thing you find on Whattomine.com or Hashrate.no simply DYOR and pick a project you believe can pump big when we turn bullish.

2. Not your keys, not your crypto.

This is Crypto 101, and yet you’d be surprised at how many crypto holders (both old a new) feel their coins are safe in an exchange or a centralized platform that offers yield service. To be honest, I’ve been tempted to park my coins and earn juicy APY’s (especially on my stables) but the constant hearing of the “NYKNYC” mantra got to me and even though I’ve played with different DeFi platforms (especially on $Matic and $BSC) I never stayed in farms longer than a few weeks, same with CEXs, having my coins safe under self-custody allowed me stay safe in the 2022 debacle that took down:

When these cryptocurrency “big” and “secure” players either went down in flames or filed for Bankruptcy, their users lost all or a big chunk of their holdings, which were either gambled away or used to pay creditors. But people who kept their crypto in their wallets, were never in danger.

3. You need to diversify your bonds

Now this is a Wu-Tang Financial piece of advice I first got from the GZA back when I was in High school but was never able to put into practice until I got into Crypto. My portfolio ever since I started mining ETH has been a mix of “blue chip”, Mid-cap and micro-cap coins.

Now this is probably not the finest portfolio for the WAGMI Moonboy crew, because having exposure to Top10 projects will kill most likely kill 1000x opportunities, nor is it the safest choice since micro-cap coins are even more volatile and tend to lose their value faster during bear markets than Blue chips.

At the end of the day, this is a marathon, not a sprint and surviving bear markets is the name of the game and this balanced portfolio has allowed me to get some big wins when the micro caps pump while at the same time endure some pain when they bleed hard against BTC.

4. Never invest more than what you are willing to lose.

2021 was a crazy year for crypto, and my first year in the cryptoverse. During the first two quarters, while all projects seemed to go up only, I was tempted to sell some real estate to expand my ETH mining farm, I mean, just go balls to the wall and get pallets of GPUs and rent a large space in an industrial part of my city. I was also approached by groups of friends and relatives who saw my rather early entry into mining that year and wanted to create a fund I could manage however I pleased.

After considering both options quickly and remembering a piece of advice I had frequently heard online, I decided it would be nuts for me to bet this big on such a volatile market and so I kept my real estate and told friends and family I didn’t feel comfortable managing their funds. While the market kept going up I felt stupid but when we hit the bear market and trillions of dollars were evaporated I realized I had made the right decision, I could have lost an important part of my net worth I wouldn’t have been able to replace in decades and I would probably have a hard time facing friends and family in meetings had I not listened to that particular advice.

5. Stay away from ponzi nodes.

During the 2021 bull market there were a lot of crypto projects that used fancy narratives to help them pump insanely for a while, only to dump as quickly as they rose. P2E, DAOs and of course NaaS (Node as a service)

When I first learned about some of these projects (Like Strongblock and Thor nodes) I was attracted to the high APYs (and boy were they high at first) but my good fren, Pitox warned me not to hop in as all seemed to be useless networks with no revenue models which relayed solely on new people setting up “nodes” to pay the first investors…they were basically fancy ponzi schemes with a Web3 façade.

I decided to DYOR and invest my coins in projects that run real nodes with real utility, like Presearch ($PRE), Streamr ($DATA) and Flux ($Flux) and even though their APY numbers aren’t 3 figures, they have been great ways to generate passive income and accumulate yield during the bear market.

Hope these pieces of advice reach some of the n00bs in our community and help them stay safu in this wild west we call crypto, I also want to thank each one of my mentors that have helped me stay afloat with their educational content. See y'all in the trenches.